Volume 80: Making Sense of Employee Ownership Investment Opportunities

About ImpactPHL Perspectives:

ImpactPHL Perspectives is a multi-part content series that explores the many facets of the impact economy in Greater Philadelphia from the perspectives of its doers, movers, shakers, and agents of change. Each volume is written directly by a leader in this space to discuss best practices and share lessons learned while challenging our assumptions about financial and impact returns. For more thought leadership like this, check out the full catalog of ImpactPHL Perspectives.

Alison Lingane, Founder of Ownership Capital Lab

Employee ownership offers over-indexed impact returns

Whether you care about the vitality of America’s small business economy, the resilience of our manufacturing supply chains, local business ownership, or structural inequality—employee ownership (EO) is an impact investment thesis that offers over-indexed impact returns.

Small business vitality. Employee retention and engagement are a high-order business need. They drive business outcomes from both a cost and revenue perspective throughout the entire operation. The often elusive “ownership culture development” comes to life when paired with stock ownership.

Local business preservation. The Silver Tsunami of retiring business owners—with over half of the locally owned businesses having owners at or near retirement age—creates urgency for ensuring that these business assets remain productive in our local economies. This is relevant up and down the entire value and supply chain and critical for preserving jobs, manufacturing and service sector companies, and local tax revenues.

Structural inequality. Stubborn income and wealth gaps choke the majority of American families, with over half of U.S. households having expenses that exceed—or that just barely meet—their incomes. Fifty-five percent lack the savings they’d need to get through a new expense spike timed with a drop in income. Black and Hispanic households each own under 3% of our country’s overall wealth (but make up 27% of households), while White households own 87% of the wealth (and are 68% of households).

“As an investor, through EO investing, you can play a role in preserving and strengthening our small businesses, which are local engines of wealth creation.”

There is an increasing recognition that systemic risks like structural inequality are “highly financially material to investors’ diversified portfolios.” As an investor, through EO investing, you can play a role in preserving and strengthening our small businesses, which are local engines of wealth creation. As it turns out, business ownership is only second to home ownership as the most important way that American families build wealth. Shared ownership—in which the full workforce at a business has an ownership stake—further deepens the positive impact on current structural inequality.

What is employee ownership?

Broad-based employee ownership (EO) is a powerful solution that preserves and strengthens local businesses and creates quality jobs and wealth for frontline workers, while also impacting intergenerational wealth.

There are many forms of EO that deliver meaningful impact for workers; all of them are important options for businesses and fund managers to have available. The different forms all share these characteristics; which form is the right one is all about its fit with the goals of the selling owner and the business:

All employees have access to ownership;

Employee voice in the workplace (which increases engagement and associated positive business outcomes);

Quality jobs (better pay, benefits, workplace culture); and

Wealth building through one or more of profit sharing, stock ownership, and retirement plans.

The main forms of EO include ESOPs (Employee Stock Ownership Plans), EOTs (Employee Ownership Trusts), and worker cooperatives. These are used most commonly in lower middle market and main street businesses. Learn more from Project Equity and Transform Finance. Other tools to get ownership or ownership-like benefits to employees include broad-based equity option or stock grants, or phantom stock, like what is being utilized by some middle-market private equity firms.

In my work, I have seen frontline workers—even in low-margin industries (like bakeries, restaurants, and housecleaning)—earn individual profit sharing in their first years of being employee-owners in the $10,000-20,000 ranges, which can effectively increase annual hourly earnings by 30% or more. Furthermore, EO can generate hundreds of thousands of dollars in retirement accounts for employee-owners, in both ESOP accounts and 401(k)s, with employee-owners having household net worth of nearly twice as high as their peers in similar non-EO companies.

There are two main approaches to transitioning companies to EO. Most existing EO companies were created with a “business owner-led” approach. EO consulting firms market EO to business owners and their advisors, then work with the business to structure and quarterback the transaction and line up financing. The transaction is debt-financed (with the possibility of warrants or earn-outs) by major banks for large ESOP transactions or by either CDFIs or CDFI-style funds for other EO forms and smaller ESOPs. A big barrier to growth is that the lenders typically require 30-70% seller financing, which limits the pool of seller interest.

“The approach to EO transitions that is growing—and where investment capital is poised to play the biggest role—is mimicking private equity.”

The approach to EO transitions that is growing—and where investment capital is poised to play the biggest role—is mimicking private equity: approaching business owners as an investment or buy-out partner and competing (often head-to-head) with other private equity offers. Most EO funds that operate in this way bring the company directly to employee ownership (versus acquiring it first, then exiting to EO). In this approach, seller financing can go down as low as 10-20%, significantly broadening the potential market of sellers.

Why hasn’t there been more EO investment?

Structural inequality and EO investing may be less “sexy”

Whether compared to cutting-edge green energy or tech solutions to social problems, investing in ownership transitions of existing companies has less “shiny object” appeal. EO investing typically focuses on regular businesses with diverse workforces that deliver steady returns. But don’t worry, the impact data and stories create lots to be excited about!

Boring businesses can make great EO investments

For investors familiar with search funds (also called ETA), the guidance for searchers is to look for boring businesses. What do we mean by boring? Companies with predictable cash flow, based on their history over decades or generations. These companies make great EO investments. This doesn’t mean that they have no growth potential, just that the baseline requirement is solid, steady EBITDA.

A misperception of risk

Because of the low familiarity with EO, it is often perceived as risky, but the data doesn’t back this up. EO is usually put in the same risk profile as private equity investing or small business lending. I argue that high employee engagement companies with a long history of solid cash flow belong in a different risk profile.

Fragmented (but growing) market of investment opportunities

There are a growing number of investment opportunities in the EO space, but the investment marketplace is still in its infancy with most funds below $25M, and the largest (of which there are only a couple) raising only $100-200M. There are a growing number of new entrants in the LMM (lower middle market). Plus, middle market commitments by private equity firms like KKR and Blackstone to phantom stock approaches are helping to raise the profile of employee ownership, especially in the mainstream capital markets.

Employee Ownership Impact Framework

Focus on depth of impact, not EO form

All forms of broad-based EO are needed given the scale of necessity to preserve small business ownership, in the context of the Silver Tsunami reality, and the opportunity to create wealth-building opportunities for workers. Different EO funds approach the choice of EO form differently: some specialize in one form based on their investment or impact thesis; others are agnostic and support all (or a couple of) forms to provide flexibility.

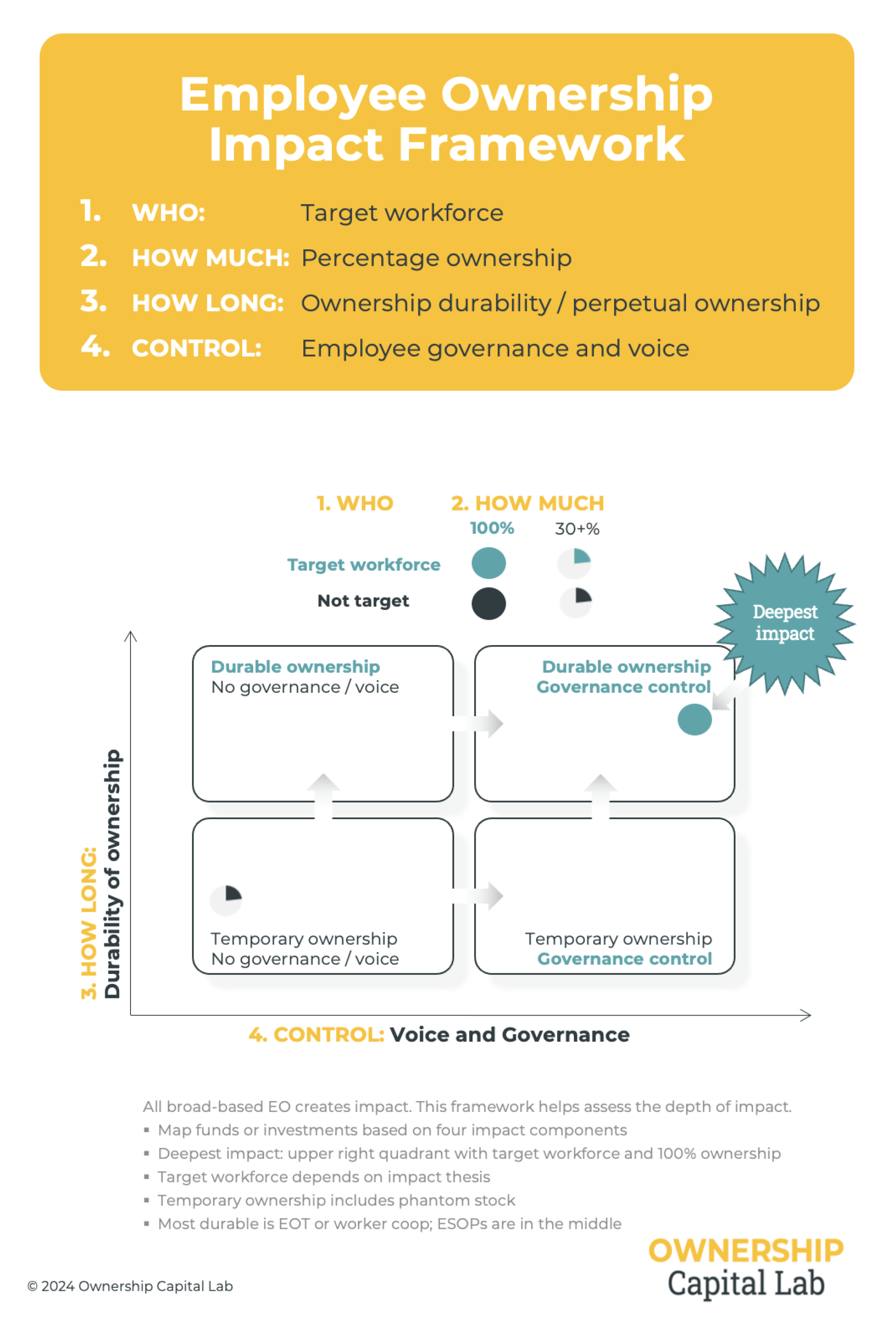

The impact potential of EO is huge, and the specific approach to EO affects the depth of its impact. This EO Impact Framework helps investors navigate impact potential across four key impact components: Who, How Much, How Long, and Control.

Employee ownership investment return profile

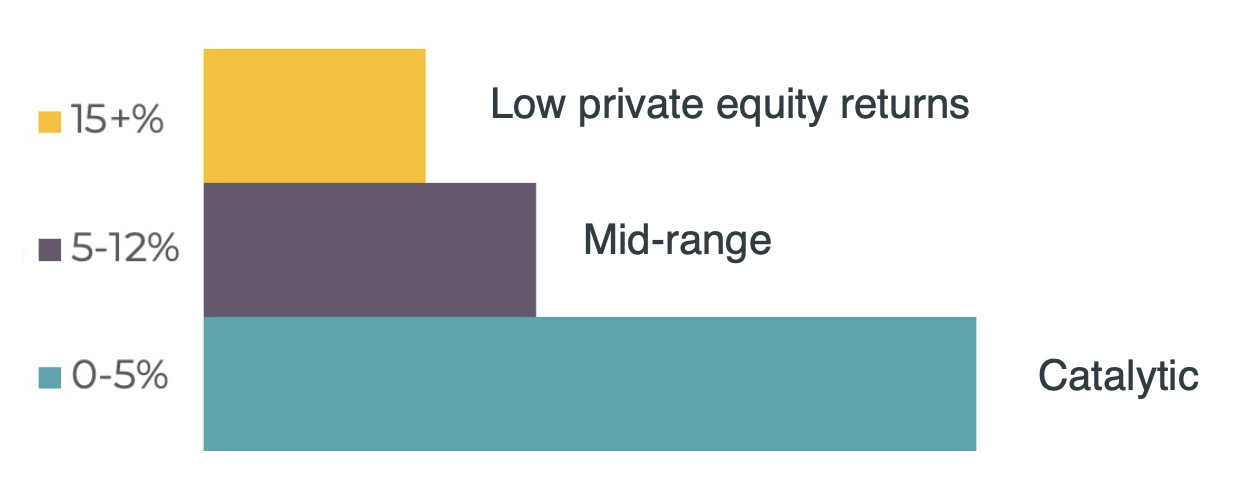

Investment opportunities in established funds are in clusters from catalytic to low private equity returns. Today, there are more funds in the catalytic return category, because there are numerous CDFI and/or nonprofit funds.

Employee ownership investment return profile

Investment opportunities in established funds are in clusters from catalytic to low private equity returns. Today, there are more funds in the catalytic return category, because there are numerous CDFI and/or nonprofit funds

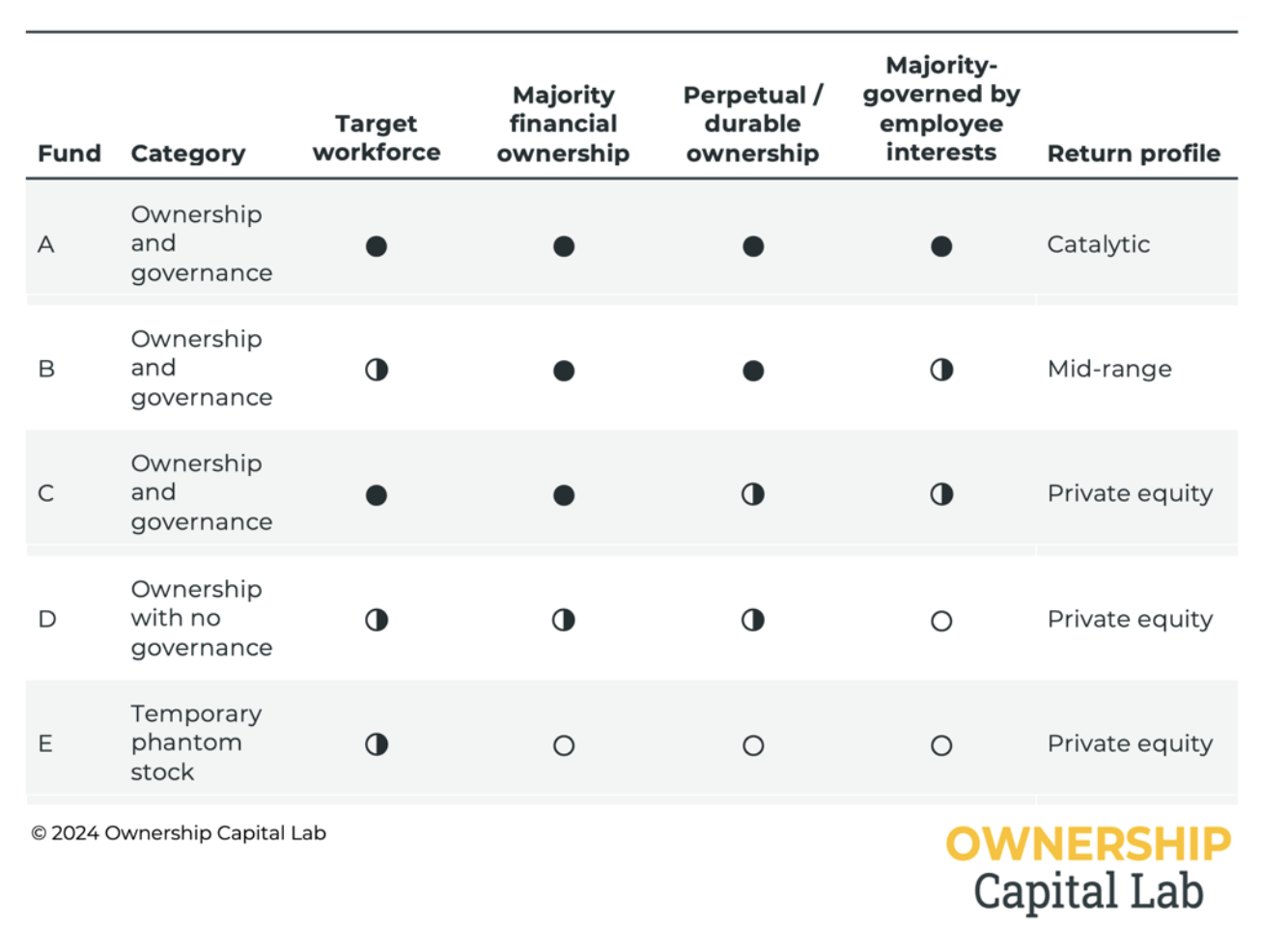

A simple comparison table (below, right) allows you to view potential investments and compare their impact depth and return profile. It also enables you to look for outliers – funds that are able to provide depth of impact across multiple or all categories.

The relationship between depth of impact and return profile is notable. This is one of the reasons I believe that we can fuel a next wave of growth of EO investing through vehicles that tap scalable sources of subsidized capital (e.g. government subsidized like SBIC or other, DAF investment capital, etc.), and / or capital priced based on EO’s adjusted risk-return profile.

How investors can help grow EO

Once you have decided you want your capital to generate over-indexed impact returns through EO investing, here are some additional ways you can help grow EO:

Think at the systems level. Invest strategically with an eye to how your capital can be catalytic to the growth of the EO space. Ask yourself what category of investment opportunities your capital could help scale.

For example:

Do you want to invest in first time fund managers? Unlock Ownership is a vehicle designed for investments from DAFs.

Do you believe your capital can have the kind of leverage you want by backing second and third funds as their managers grow their impact?

Is there a particular investment vehicle that your investment committee is more familiar with that could be an easy starting point? For example, SBICs or CDFIs? There are many CDFIs that focus on EO, and at least one employee ownership SBIC.

Ask about sharing equity: Encourage Lower Middle Market or Middle Market funds that aren’t specific to EO to incorporate ownership for employees into their deal structures. Santhosh Ramdoss at Gary Community Ventures has a standard question he asks all funds looking for investment: What equity are you sharing with the people creating economic value?

Bring EO into the investor convenings. The conversations you take part in at investor convenings including more formal investor gatherings allow you to lift EO within these circles. Ask to have employee ownership on the agenda (we’re always happy to help you with this!) and to invite a couple of different fund managers representing diverse EO Investment theses to the conversation.

Tell your friends. One of the biggest reasons employee ownership hasn’t grown to its full potential is that most people haven’t heard about it. There are efforts to get EO into business school curricula and programs to train CPAs and other business advisors about EO. Don’t underestimate your ability to spread interest in EO by talking about it widely. The opportunity is huge – we don’t need to guard it as a best-kept secret!

Read ImpactAlpha’s article: Seven policies to mobilize private financing for the Ownership Economy

Alison Lingane is a nationally recognized employee ownership expert. A serial social entrepreneur, she has dedicated her career to leveraging business as a force for good. Alison is the Founder of the Ownership Capital Lab, which focuses on capital as a growth and scale lever for employee ownership. The Lab identifies, pilots, and supports the uptake of strategies for financing employee ownership at greater scale. This work builds on her 10+ years as co-founder of Project Equity, a national leader in the movement to harness employee ownership to maintain thriving local business communities, honor selling owners’ legacies, and address income and wealth inequality, and her role as founder and manager of the Employee Ownership Catalyst Fund. Alison’s successes have been recognized by fellowship invitations from Echoing Green, The Aspen Institute, Rutgers University, the Just Economy Institute, UC Berkeley’s Haas School of Business, and Ashoka, where her work was featured in the book America’s Path Forward. In 2022, with her co-founder Hilary Abell, Alison received the Heinz Award for the Economy, established to honor the memory of U.S. Senator John Heinz and to celebrate the vision and spirit that produce achievements of lasting good. Alison holds a B.S., magna cum laude, from Harvard College, and an MBA from UC Berkeley’s Haas School of Business.